Written by Mitchell Beer this article originally appeared in The Energy Mix on June 3, 2021.

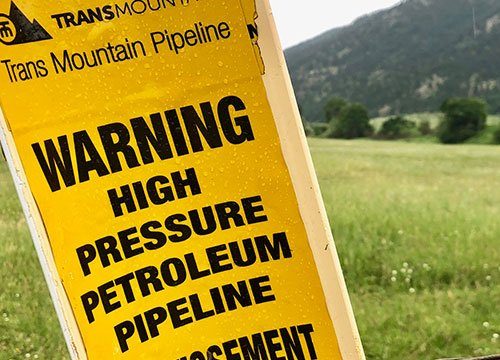

Another insurance company is abandoning the controversial Trans Mountain Pipeline.

“We currently insure the Trans Mountain pipeline, but do not intend to renew when the policy expires in August 2021,” wrote David Snowden, senior VP of group communications at Argo Group US, in a widely-circulated email. “This type of project is not currently within Argo’s risk appetite.”

In a follow-up to Public Citizen climate campaign coordinator Elise Peterson-Trujillo, Snowden confirmed the decision applies both to the existing Trans Mountain pipeline and the C$12.6-billion expansion project now being run by a federal Crown corporation.

The news lands just days after CBC cited limited access to insurance as a serious, new obstacle for pipeline and tar sands/oil sands projects. The Insure Our Future campaign coalition says Trans Mountain is in the process of lining up coverage for its 2021-2022 fiscal year.

“The decision by Argo Group comes even after the operator for Trans Mountain received regulatory approval to protect the identity of its insurers,” The Canadian Press writes. “Trans Mountain had argued that identifying its insurers could make it harder to get insurance at a reasonable price and prejudice its competitive position.”

Argo, one of many firms in the Lloyd’s of London empire, “joins more than 10 insurance companies to reject the controversial tar sands pipeline,” writes Insurance Business Canada. “It is the first insurer to drop the pipeline in this year’s round of policy renewals, and the first to act following the Canadian authorities’ decision to hide the project’s insurance backers from public scrutiny.”

A Trans Mountain spokesperson did not specifically answer questions about whether the government-owned pipeliner agreed with Argo’s risk assessment, the factors that might have driven the insurer’s decision, or whether Argo’s withdrawal would make the pipeline expansion project more difficult, expensive, or risky to complete.

“Trans Mountain has all the required and necessary insurance in place,” she said in an email. “Trans Mountain is committed to providing the [Canada Energy Regulator] with full information about our financial resourcing and ensuring Canadians know that we are sufficiently insured.”

Janet Ruiz, director of strategic communication at the U.S. Insurance Information Institute, listed a variety of factors that shape companies’ “risk appetite”, and their sense of “how much of any type of risk they have on their books”.

In today’s business environment, “they’re assessing how much climate risk they can take on, what they’re investing in, cleaner energy, all these type of things,” she told The Energy Mix. “Each company assesses its profile. They’re looking at carbon neutrality and how much they’re committing to cleaner energy for the future” across their own operations, their investments, and the clients they agree to insure.

Environmental, Social, and Governance (ESG) factors are now another major consideration, she added.

For commercial investments as small as a restaurant or as big as a pipeline or many other form of infrastructure, insurers have managers in place to help their clients mitigate risk and prevent losses, Ruiz explained.

“They give advice,” she said. “They often do inspections. They will help you figure out a better way of managing your loss prevention.” And “smart companies take advantage of that and work with their loss control people from the insurance company and take their advice. They ask for advice. They really expose themselves to get the help they need.”

Otherwise, “companies who are trying to hide things don’t get that type of help. Eventually, the losses are going to come, and they may not get renewed in the end if they’re not managing their risk appropriately.”

Ruiz would not comment on any specific insurance decision. But in March, two insurance industry veterans told The Energy Mix that Trans Mountain was diverting attention from its own shoddy safety culture by blaming campaigners for its rising insurance premiums.

On top of a general tightening of insurance markets driven partly by climate risk, “a 68-year-old pipeline is a huge insurance risk,” and “it’s only getting older every year,” independent economist Robyn Allan, a former president and CEO of the Insurance Corporation of British Columbia, said at the time. After a series of workplace accidents forced the company to shut down construction operations for a couple of months of retraining, “you’ve got this situation where Trans Mountain is showing that they’re a huge safety risk, and any insurer would be worried about that.”

“So many companies now are looking at their investments, and they want to divest themselves of companies which are supporting companies that aren’t helping the climate,” added Angus Ross, a mostly retired reinsurance executive and former member of the National Round Table on the Environment and the Economy. “Trans Mountain will not be helping the climate. So if a public company decides to issue insurance policies on pipelines, funds which are really ESG-conscious are not going to have money invested in those companies.”

With next year’s round of insurance approvals kicking off, campaigners are turning their attention to the next providers in line and encouraging them to follow Argo’s example. Trans Mountain’s former lead insurer, Zurich Insurance Group, has already jumped ship, as have German insurance companies Talanx and Munich Re and Lloyd’s syndicate the Lancashire Group.

“The Group does not have an appetite for underwriting direct insurance exposure for the Trans Mountain pipeline,” Lancashire said, in a statement quoted by Insure Our Future. “The Lancashire Syndicates will be closely adhering to the Lloyd’s market policy on fossil fuel insurance.”

“We commend Argo and the other insurers for leading the way by dropping Trans Mountain,” said Charlene Aleck, spokesperson for the Tsleil-Waututh Nation Sacred Trust Initiative, in the Insure our Future release. “In addition to fuelling the climate crisis, this pipeline represents an ongoing violation of Indigenous rights. The lack of free, prior and informed consent is a material risk that most insurers have not fully captured, and that needs to change. We are calling on the rest of the Lloyd’s syndicates, as well as AIG, Chubb, and Liberty Mutual, to follow Argo’s path.”

“Argo’s commitment to not renew insurance of Trans Mountain should be a signal to the rest of the Lloyd’s market to follow suit,” agreed Insure Our Future European Coordinator Lindsay Keenan. “Lloyd’s CEO John Neal needs to make a clear statement on behalf of all of Lloyd’s members that no Lloyd’s syndicate shall renew insurance for any aspect of the Trans Mountain tar sands pipeline.”

Insure Our Future says Argo’s news comes less than two weeks before a week of action June 14-21, in which groups from the United States to Germany to Sierra Leone “will be targeting the likely insurers of Trans Mountain” and “urging them to follow Argo’s lead.”

Read the original article here: https://theenergymix.com/2021/06/03/trans-mountain-pipeline-loses-another-insurer/